What's wrong with Bitcoin BTC?

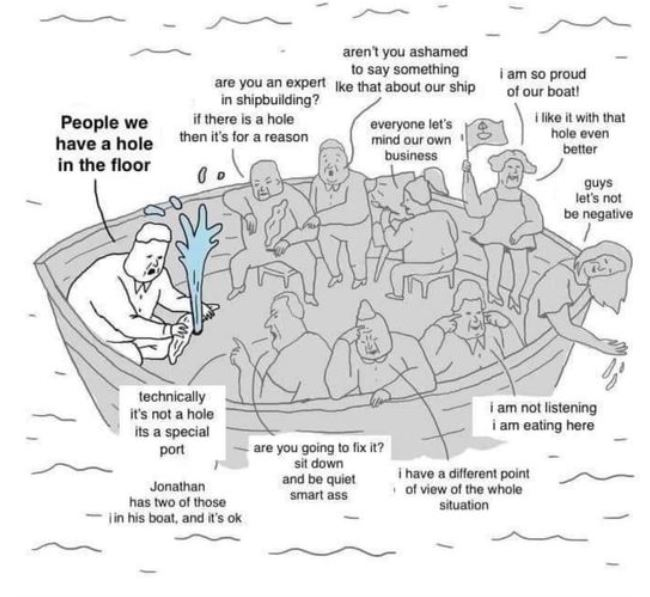

The problem is one problem. The response is another.

In August 2017, the original Bitcoin split into Bitcoin Cash (BCH) and Bitcoin (BTC) under very controversial circumstances.

Although the specific issue in contention was the 1MB blocksize transaction limit, the dispute was so intense (and ultimately fractured the community in two) because it has wide-reaching project-defining implications. These differences continue to compound as the BCH and BTC communities diverge socially, philosophically, economically and technically over time. As of 2025, the gap now includes a lot of things that BTC wants but BCH already has, although there are many further differences too.

As evidence this critique is not blind tribalism, The Bitcoin Cash Podcast maintains a clearly-defined criteria for which it would admit these criticisms were misguided & defect to BTC.

The Bitcoin Cash community chose to increase the blocksize limit and retain the original digital cash mission. It was worth splitting and even ceding the branding, because maintaining a restricted blocksize limit and choosing the "digital gold" path as BTC decided has the following ramifications:

- High fees: The most obvious side-effect of a restricted blocksize. Not only does it discourage consumer adoption directly through cost, it secondarily causes frustration due to unpredictable payment experience and creates an impossible to overcome negative feedback loop - the more adoption BTC gets the more costly it becomes to use and thus the harder it is to get further adoption! This alone largely explains BTC's declining cryptocurrency market share percentage. BCH has low fees, and they will stay low as volume rises although some BTC adopters have a misconception that this is not feasible.

- Slow transactions: BTC abandoned the original Bitcoin design of 0-conf instant transactions. A restricted blocksize creates a double-blind auction for BTC transaction fees, making transaction inclusion in a block unreliable and therefore waiting times unpredictable. In addition, BTC added rules called "Replace By Fee" to their nodes, allowing transactions to be replaced with a higher fee. This makes unconfirmed transactions deliberately unreliable and increases payment risks for the receiving party (the sending party may fraudulently revoke the funds by respending with a higher fee to themselves). Although originally opt-in (which was already bad enough), this problem got worse when Bitcoin Core doubled down by providing an option for nodes to default ALL transactions, even the ones that did NOT volunteer for it, into optional respending ("Full RBF"). This has now been quietly slid into Bitcoin Core by default. BCH has taken the opposite approach, retaining the original "First seen policy" for nodes which creates high reliability of instant transactions, and strengthening this tech further with Double Spend Proofs.

- Censorship culture / centralised political control: The BTC side of the fork were the ones to embrace censorship of competing ideas, and to this day maintain an aggressively hostile approach to outside influence. They chose to treat the Bitcoin Core developers as high-priests that could not be questioned (they did not develop a decentralised governance process like BCH), to disavow most forms of forward technical progress on the chain (aka "no hard forks"), and to give up on the idea of a useable currency. None of these things is a recipe for long-term success, and this culture has become deeply ingrained in the most passionate BTC supporters.

- Unsustainable mining incentives: Satoshi's original whitepaper and later writings explained that long-term security would be funded by transaction fees - individually small but in aggregate becoming substantial enough to replace the disappearing block reward subsidy. This is still the path Bitcoin Cash is on. Bitcoin BTC instead proposes to have high fees on the main chain to comprise the same subsidy, but that model is not working as users simply route around BTC to transact with lower fees on any of the competing blockchains (including BCH). Whenever congestion / fees spike, moving closer to sustainable levels, the market adjusts by pushing demand onto competitors until fees go back down, and since BTC will never exist in isolation from competition it cannot sustain its security in the long run. BTC advocates claim they have over 100 years to solve this issue as there will still be a block reward, but the diminishing reward means there will be less than 0.8 BTC / block by 2032, so unless there is titanic price appreciation in that time the situation needs serious improvement within a decade. Note this detailed analysis of each coin's mining economics and sustainability.

- Vulnerability to regulation: Focus on becoming an investment-grade asset instead of a daily, consumer currency makes it far easier for politicians and regulators to clamp down on adoption. Investment assets are far easier to control at centralised exchange chokepoints, easier to justify taxation rules and reporting requirements. In contrast, the "digital cash" model of BCH creates grassroots support and usage among a population such that politicians are rapidly contending with constituents interests in continuing their BCH commerce as unburdered as possible. A pragmatic reality of lots of local business support and voters that like their crypto to be useable every day makes burdensome regulation far less feasible for politicians.

- Decreased on-chain privacy: Less on-chain transactions makes financial surveillance by chain-analysis far simpler by default. It is also far easier to track payments because high fees encourage users to pool their funds in tracked locations like exchanges, instead of regularly trading peer-to-peer which is harder to observe. Also, high on-chain fees make the use of coin mixing much more expensive, and therefore less commonly used. Bitcoin BTC has a lot of issues in this regard, while BCH does not.

- Multi-wallet usage: High fees and decreased on-chain privacy make it more expensive and cumbersome to have separate hot and cold wallets, transfer funds between them, or have different wallets for different organisational structures. This is a bad user experience, and disincentivizes correct financial management.

- Environmental inefficiency: Although Proof of Work mining is not the environmental disaster that it is often criticised as, this is only true without a blocksize limit. Scaling on-chain improves energy efficiency per transaction (same hash power / mining expenditure validates more transactions). Off-chain transactions do not assist energy efficiency in the same way because the mining power secures only the base layer transactions.

- Haphazard development: As per community desire NOT to have a defined process for code improvements, innovation on BTC happens obtusely & inefficiently. Consider the creation of Ordinals, Inscriptions & BRC-20 tokens via discovery of a Taproot exploit on BTC in comparison to the thought-out, well-engineered BCH upgrade to CashTokens. Failing to plan is planning to fail, so it is no surprise that technical debt and inefficient workarounds are compounding on BTC while BCH deliberately & methodically progresses towards an optimal environment for a scaleable currency where innovation can flourish.

- Quantum vulnerability: The unknown but impending horizon for quantum computing is a huge issue for the BTC community. BCH has already built in protocol upgrades allowing the rollout of quantum-secure wallets, but BTC is mired in technical debt & an inability to upgrade for even a potentially existential thread, another side effect of the Hijacking.

- Ineffective solutions: By censoring community debate, shouting down detractors and irrationally coping with illogical and self-imposed bad ideas, the BTC community need to invent and spend a lot of time and resources on complicated solutions to their self-created problems. The Lightning Network for reducing transaction fees and improving sending speed is one classic example. Another example is their inability to prepare for quantum computing as noted above. Because of the titanic and ongoing investment of limited community resources into Rube Goldberg projects like these, the BTC community destroys the efficiency of their own progress and spends their time throwing good money after bad - a handicap much of their competition (including BCH) does not suffer to anywhere near the same degree if at all.

Note that the Bitcoin BTC community cannot easily reverse course, precisely because it is decentralised and because anyone who prefers the BCH approach is already in the BCH community.

See also: If BCH improved on BTC by raising the 1MB block size limit, what if BTC does the same?

See also: Is Bitcoin Cash (BCH) the real Bitcoin?

See also: Should (or will) Bitcoin Cash rebrand?