Will BCH fees rise? Aren't BCH fees low due to low transaction volume? Won't rising volume / price increase fees?

No.

Many people, particularly BTC proponents, believe that BCH's current sub-cent fees are simply a result of low transaction volume. They argue that if BCH demand grows comparable to BTC, fees will have to rise. They believe BCH's low fees are a result of low demand, rather than superior engineering & proper economic design.

This is incorrect. BCH has low fees because blockspace supply is not artificially restricted. Demand higher or lower than BTC is irrelevant, what matters is demand lower than BCH blockspace, which is far higher than on BTC and will be further increased as necessary. Fees would only rise if BCH demand was constantly overflowing its own available blockspace (as it is on BTC), which would require an order of magnitude more demand than BTC (because BCH has more than an order of magnitude more capacity today, and even more in future). By increasing blocksize (capacity / supply) ahead of transaction volume demand & allowing the mempool to clear in each block (or, infrequently at spikes of enormous network demand, within only a few blocks), BCH can maintain low fees set by miner commodity costs of storage space rather than by consumer competition to prioritise their transaction within artificially limited blockspace.

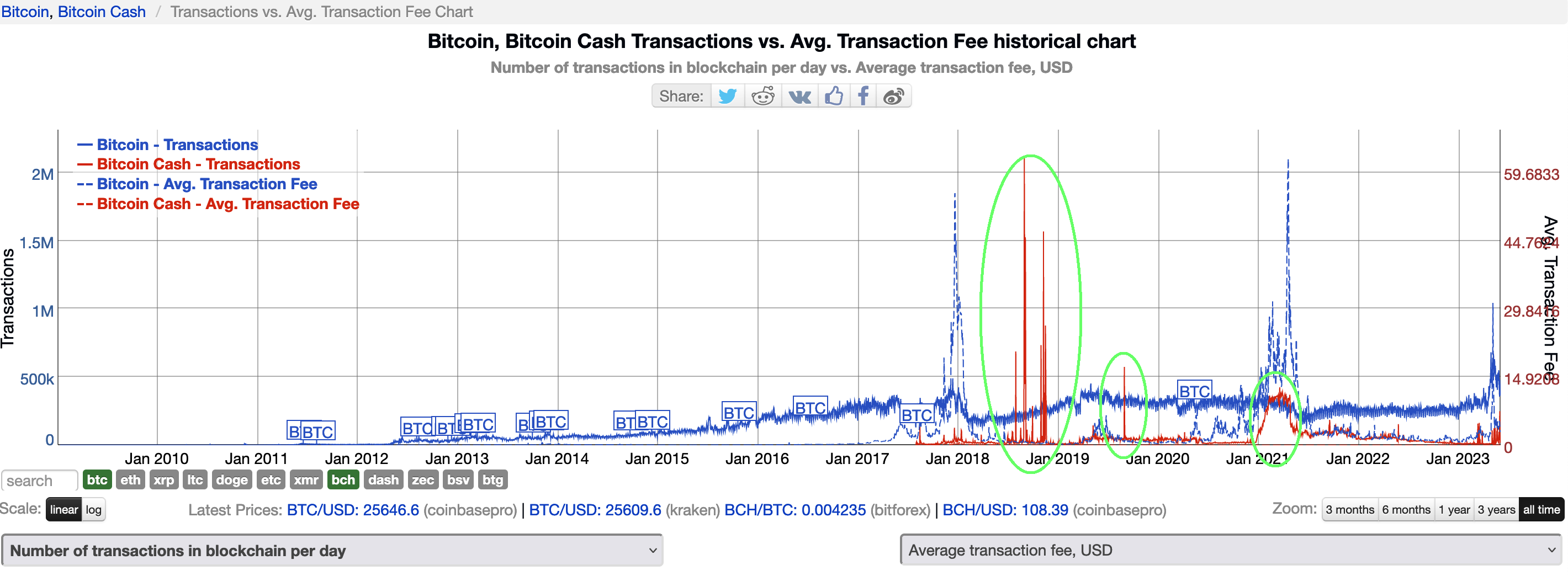

This is not just theory, it has been validated in practice. On several occassions, BCH has processed more daily transactions than BTC - and fees have not even flickered above their typical sub-cent costs.

_ Note the periods highlighted with green circles, where BCH transaction volume (red) has exceeded BTC transaction volume (blue) and yet the BCH average fee line (dotted red) is effectively invisible because it is flatlined along the 0 on the x-axis, while BTC average fee line (dotted blue) irregularly spikes as mempool congestion causes a fee crisis. Source_

If this direct evidence is not enough, note that the same thing can be observed on many other cryptocurrency blockchains, such as Litecoin or BSV. Transaction volumes on UTXO chains can far exceed BTC levels without causing any rise in fees if sufficient blockspace is available.

Price / value increases

As BCH continues its rise to global reserve currency, the value of BCH satoshis will rise in comparison to the US Dollar as well as real goods, other fiat currencies & other cryptocurrencies. Sophisticated observers will note that at a price of US $100 / BCH and a network transaction fee of 1 satoshi / byte the average BCH fee may be only $0.005 in 2023 US Dollars. But if price rises dramatically, say 3 orders of magnitude to US $100 000 / BCH, then a BCH transaction fee at the same 1 satoshi / byte rate is now not so cheap at $5!! A rising coin value may have the same "cheap" fees in BCH terms (1 sat / byte) but far higher fees measured against USD (or other fiat/cryptos, or most importantly, against real goods). Will rising BCH value cause BCH transactions to become more expensive in real terms over time?

Once again, the answer is no. The Bitcoin Cash community is aware of this dynamic & plans are already in discussion to lower the network fee commensurate to price rises. If the price rises 100x or more & fees are increasing in real terms, then network fees will be lowered to match from 1 sat / byte to 0.1 sat / byte or 0.001 sat / byte. The Bitcoin Cash community is very diligent about capacity planning & scaling & aims to keep fees low in real terms all the way to global reserve currency scale.

Etherum Fees

Some people also believe that the scaling difficulties of BTC & ETH - the two largest cryptocurrencies by market cap - prove that fees are a required tradeoff of scaling a decentralised blockchain. This ignores the difference between BTC & ETH. BTC has high fees because of a political problem (i.e. the hijacking & its many flow on consequences). BCH chain split to move past these issues and is not handicapped by them. On the other hand, ETH has high fees for technical reasons (account model chains are far less scaleable than UTXO chains) instead, but BCH is a UTXO chain not an account model chain so this will also not be an issue for it.