Stats

Last updated: 25th November 2024

Follow links for up to date information.

The price of Bitcoin Cash (and almost every cryptocurrency) is incredibly volatile due to relatively low adoption, and fluctuates wildly based on a number of unpredictable factors and general hype-based sentiment. This does not give a very good indicator of real growth of the Bitcoin Cash economy, and therefore other metrics are helpful in monitoring the growth and progress of the currency. For a full explanation of why it's so difficult to assess the real number of Bitcoin Cash / crypto users and we are at best guessing, see this segment of the podcast.

The Bitcoin Cash Podcast

As a source of information about exclusively Bitcoin Cash, it can be expected that increased growth in the metrics of this podcast indicates increasing global interest in Bitcoin Cash. Full data tracking monthly reach of the Podcast can be found here.

Audio downloads

Note that the graphs only show a 1 year timeframe with no possibility to see the whole history, plus they don't necessarily start with their scale at 0 (confusingly). Also note that the current month will usually show a big drop off in the graphic since it is currently in progress.

| Metric | 26 Jan 2022 | 23rd Mar 2022 | 26th Jun 2022 | 25th Sep 2022 | 23rd Dec 2022 | 29th Sep 2023 | 23rd Dec 2023 |

|---|---|---|---|---|---|---|---|

| All time downloads | 4342 | 5317 | 7174 | 8953 | 10707 | 18056 | 20565 |

| 30 day downloads | 326 | 468 | 773 | 673 | 614 | 760 | 986 |

| RAS (Rolling Average Subscribers) | 44 | 54 | 64 | 39 | 61 | 63 | 63 |

RAS approximates the unknowable regular podcast subscribers by averaging 24 hour downloads for the most recent 3 episodes.

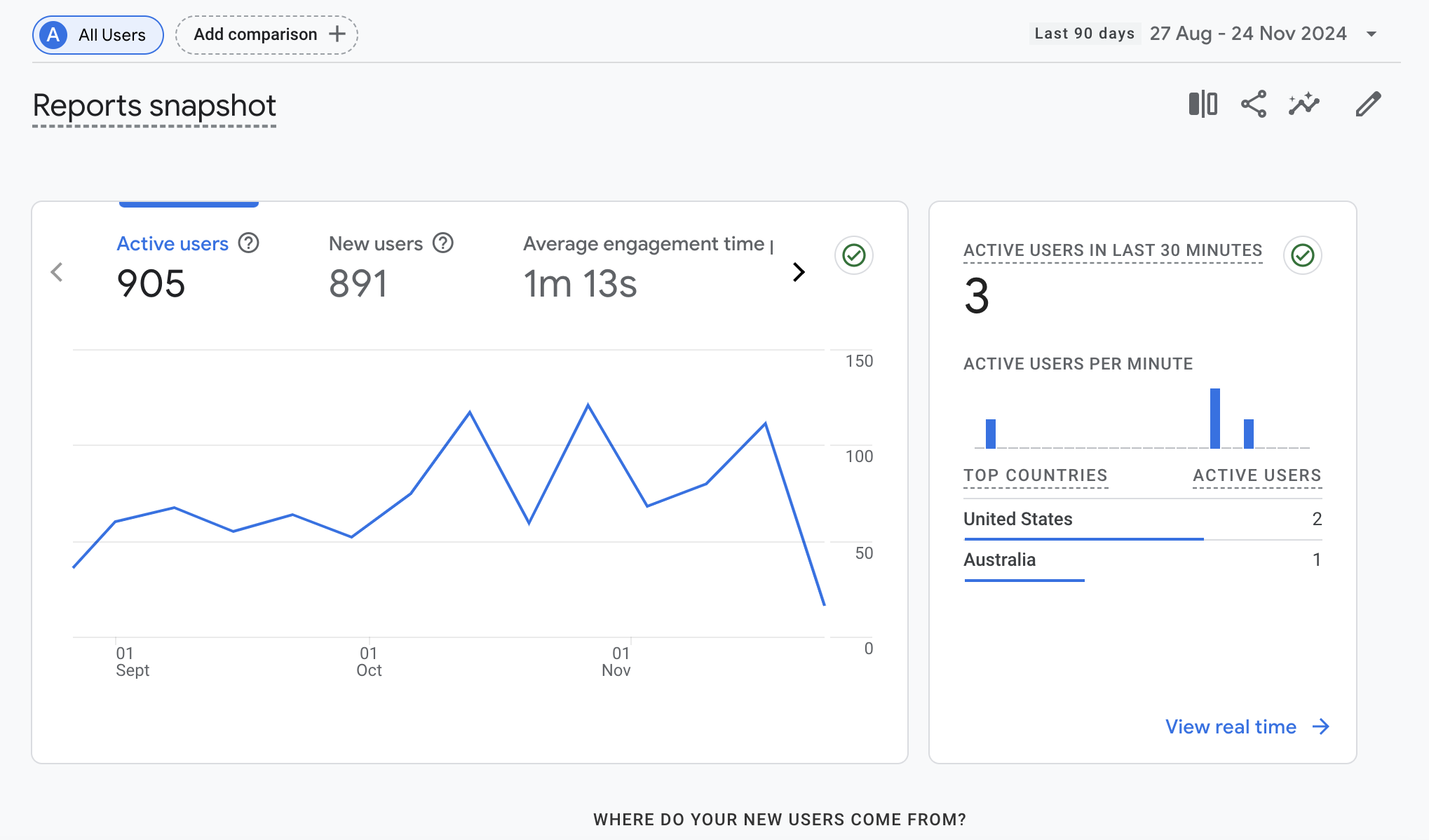

Website page hits

For this website! Started tracking October 2021 with Google analytics.

BCH Projects

- A Fifth Of Gaming stats page

- Selene Wallet provides statistics inside the app on the "Explore" tab

CashTokens & DeFi

- Tokenaut: CashTokens ecosystem growth

- DeFi Llama: BCH TVL & protocols

- Moria Money stats: MUSD stablecoin stats

On Chain BCH Data

- BCH Explorer (by Melroy van den Berg)

- Ninja BCH Block Explorer

- Jett Scythe's BCH Grafana Dashboard

Network Activity

- CashFusion Red Team stats page to check in on how Bitcoin Cash privacy is coming along. Also see their beta site with upcoming improvements.

- AnyHedge growth stats: to see how AnyHedge is doing.

- Coin.dance

Check on growing TVL of AnyHedge/BCH Bull, Cauldron DEX & others.

Ecosystem Activity

A couple of companies provide very useful insights into BCH usage and growth. Hopefully more and more crypto and especially BCH companies will begin to publish internal metrics to increase transparency and confidence in the scene.

- Bitpay stats page - A cryptocurrency payment processor that gives some indication of retail usage at point of sale. Bitcoin Cash (~10%) is often the 2nd most used cryptocurrency after BTC (~60%), once again outperforming the price differential. Note that Bitpay's total payment volume is relatively flat, so a change in coin distribution might indicate regular users changing their preferences. Note also that due to heavy Know Your Customer regulations, and growth in the Bitcoin Cash scene is likely happening directly on chain.

- Sideshift.ai research - Sideshift is a crypto-to-crypto non-custodial exchange. They publish weekly reports on which coins are popular both for depositing/settlement. This can give insight into whether BCH is increasing/decreasing in popularity among the "serious crypto" crowd that don't bother with fiat based exchanges any more.

Smart BCH

SmartBCH assets are currently under seizure by an insolvent CoinFlex. This is a complicated situation, detailed breakdown can be found in Episode 52 and Episode 53. Recent updates on Episode 60.

It is critically important to research SmartBCH and understand the risks thoroughly before using it in any capacity at this time. Further updates will of course appear on the podcast where notable change has happened, but The Bitcoin Cash Podcast suggests avoiding SmartBCH entirely at this time.

For insights on growth of SmartBCH, take a look at these stats sources:

Transactions & Sent In USD

Simple but contextually effective markers of progress:

Comparisions to BTC are often more useful than USD, as both coins are similarly affected by fluctuations in the crypto market and their on-chain blockchain metrics are directly equivalent (this is not true in the case of some other cryptocurrencies such as Ethereum).

Note that despite a price ratio of about 1 BTC to 80 - 100 BCH, BCH is already doing between 25 - 50% of the daily transactions of BTC, and settling usually about 10% of the USD value / day. This shows that despite the brand and price disadvantage, it is punching well above its weight class. Note also that BTC transaction volume has been flat at a maximum of 400k for the last 4 years, so BCH is slowly closing the gap.

Other stat sources

CBDCs

Keep an eye on the encroaching tyranny.