Should (or will) Bitcoin Cash switch to Proof of Stake?

No.

No matter how much they disagree on everything else about Bitcoin, all Bitcoin forks agree on the need for Proof Of Work. Source

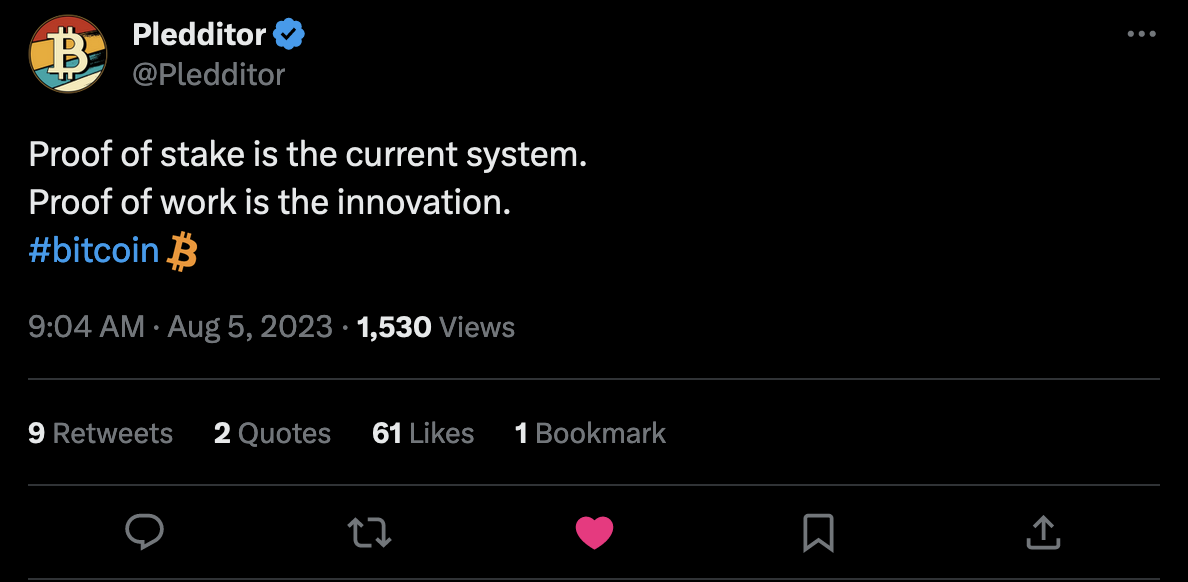

If Bitcoin had not been Proof Of Work, it wouldn't have been revolutionary, and the cryptocurrency industry would not have thrived or grown to the point it has today. Proof of Stake alternatives are able to exist largely in contrast to Bitcoin, rather than obsoleting it. Fundamentally, Proof of Stake is similar to the existing fiat system - the rich control the system in a self-referencing loop. The rich are closer to the production of new coins and thus the rich get richer.

The Bitcoin Cash community at large shows little to no interest in a switch to Proof of Stake & there are many alternative coins available to investors with a strong preference for that system.

Proof of Work has a number of critical advantages:

- Initial distribution: Proof of Work gave a mechanism for the initial supply of coins to be distributed anonymously, fairly, and without a central entity. Ethereum replicated this model, but most other Proof of Stake coins instead had an initial distribution that more resembles a pre-mine or centralised airdrop.

- Anonymous participation: Proof of Work allows for any new miners to join the network at any time, permissionlessly & anonymously. By contrast, Proof of Stake systems not only have a known set of validators but entering the set of validators requires permission from the existing group! Although Proof of Work isn't flawless, it provides better resistance to censorship capture in this respect.

- Fork choice: A deliberate, decentralised chain split is not possible on Proof of Stake coins. If a minority set of validators find a need to upgrade to a different set of network rules there would have to be some element of central coordination around a synchronised validator list update. This drawback is especially pertinent to the BCH community, who have encountered the necessity to resolve project governance disputes through a contentious chain-split on 3 separate occassions (with BTC, BSV & XEC). In light of this history it seems foolhardy to abandon the option of this final-resort dispute resolution mechanism by adopting Proof of Stake. See below "Resistance to plutocratic capture".

- Resistance to plutocratic capture: Although it would not be pleasant, a 51% mining attack on Bitcoin would not end the chain in perpetual submission. Among other defences, there is always the potential for more mining chip production and more hash rate to come online and claw back hash rate distribution or the development of new technologies allowing more efficient mining. It would also be very evident such an attack was ongoing. In contrast, Proof of Stake systems silently captured by a majority anonymous ownership of coins can perpetually rent-seek and censor the chain. In other words, a Proof of Stake 51% attack is game over - permanently. The controlling interest cannot be forked off the chain, and the community would need to essentially start a new chain (probably a Proof Of Work chain) to create a new, fair coin distribution.

- Strong objectivity: An individual Proof Of Stake node cannot determine which of two potential chains are valid without reference to other peers. Offline transactions are not possible in an environment where sovereign determination cannot be conducted.

- Physical scarcity: Proof of Work mining ties coin generation to cryptographically-provable energy expenditure. This "external anchor" to the physical world ensures valuable human effort is always going into the chain.

- Clean energy development incentive: Contrary to common misconception, Proof of Work helps incentivise clean energy and is not the environmental disaster it is frequently villainised as.

- Legal status: The inconsistent & unclear approach of international regulators, particularly in the United States of America, is a classic example of government incompetence and the "regulation by prosecution" approach by the SEC should serve as clear evidence to observers how little fairness, justice or innovation is valued by government officials who are more concerned with propping up obsolete banking interests than in protecting investors or encouraging entrepreneurs. Nevertheless, in the current (regrettable) state of affairs, Proof of Stake coins appear to be far more likely labelled or prosecuted as unregistered securities by the SEC. Although this is not an advantage The Bitcoin Cash Podcast finds particularly fair or desirable for Proof of Work coins such as BCH, it is neverthless the current state of affairs.

- Status quo: The Bitcoin Cash project has always been Proof of Work. Switching would be a titanic technical & community effort - with little compelling evidence for any advantage in such exertion.

The majority of cryptocurrencies launched since 2016 have chosen Proof Of Stake. This is because bootstrapping a large, secure mining industry in the way Bitcoin has is difficult and expensive. This doesn't prove Proof Of Stake's superiority so much as it indicates Proof Of Stake has a low barrier of entry and is easier to compete with.

For Bitcoin Cash specifically, maintaining SHA256 mining / Proof of Work is critical to flippening BTC. Low hash rate is less of a problem than it is an opportunity. The potential to reclaim the majority of SHA256 mining and benefit from the enormous innovation & vested interests in that area is a unique trait that many competitors to Bitcoin Cash can never acquire & Bitcoin Cash would be foolish to relinquish.

See also: What about Ethereum (ETH)?

See also: Is low hashrate a problem?