If BCH is so great, why is the price (against BTC or USD) so low?

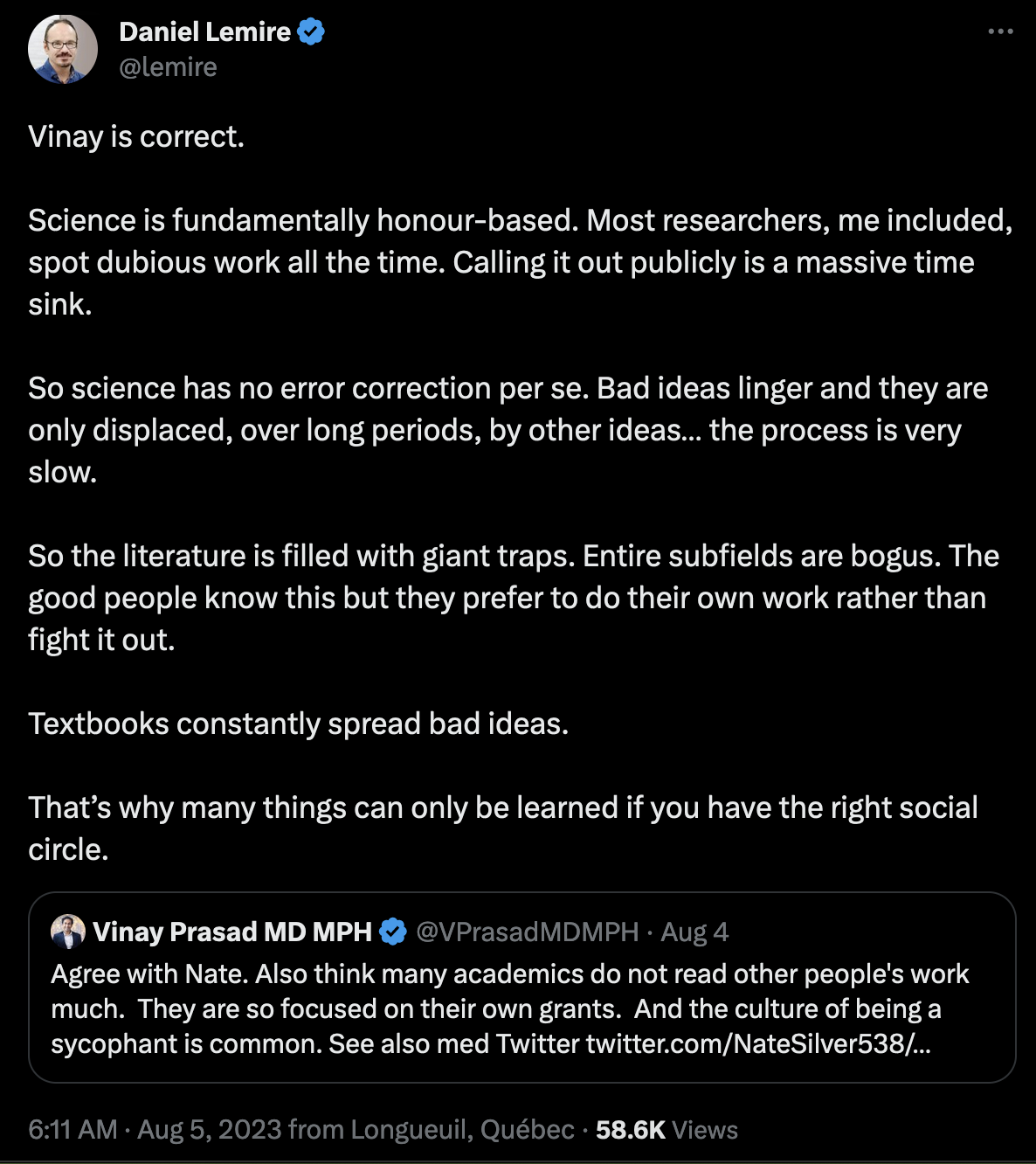

As in science, so cryptocurrency. Lies & scams are propogated exponentially faster & cheaper than the truth (or real adoption). In cryptocurrency, scams launch & pump in price every day (only to crater within months) - while real projects take years & years to gain recognition for their longevity & serious results. A lot of time is required to separate the two since the few people who are experts do not have time to debunk it all as well as also push forward the state of the art & build real viable companies. Source

Bitcoin Cash is a mission-driven project to become the global reserve currency. As a result of the Bitcoin hijacking and extensive propaganda there's been significant bumps along the path to spreading Bitcoin Cash - including the frequently cited market price. This is to be expected, the controllers of the existing financial system are not going to give up their ability to endlessly inflate the currency & steal everyone's purchasing power without a fight!

Although an increasing price is not the point of BCH, the price matters a LOT in cryptocurrency. Higher price:

- Increases project visibility & credibility

- Attracts mining hash rate

- Increases financial resources of BCH holders to continue the mission

- Attracts speculator interest, driving further network effect

- Increases market depth & liquidity, enabling further usage as money

Although there are a lot of reasons to expect BCH to outcompete BTC as the real Bitcoin and become global reserve currency in the long run, it is still true that so far BCH has performed poorly on the open market, particularly with regards to the exchange rate. All BCH adopters should take a low price as an indicator to do better & more improvement is needed somewhere - because even if the market may change its mind in the long run, it is also signalling the way it is today for a reason.

Even if it's true that BCH is not dead, BTC has not won & BCH can flip BTC, doesn't this market vote empirically demonstrate that BCH isn't that great after all?

How can the price be so low if BCH supporters are correct that it's much better than BTC?

The truth is that BTC & many other coins have a big lead across important metrics such as network effect, transaction volume, market liquidity, brand recognition & more. This is not universal, BCH has built a significant lead over BTC in some notable areas, but not yet enough to turn the tide on others.

BCH all time low against USD: Roughly $80 in Dec 2018.

BCH all time low against BTC: Roughly 0.00341 (around BCH:BTC 293:1) in March 2025.

BCH all time lowest rank on coinmarketcap.com coin rankings: #31

BCH is always improving, the rate of decline has slowed in recent years - and even reversed significantly, but it has not yet turned the trend permanently against the network effect of most larger competitors (including BTC).

Community harmony & hard work is ongoing to address this, but BCH is certainly not for the short-term oriented or faint of heart.

What can be done

The BCH community is keenly aware that building higher market value is critical to its success and is taking steps to attack the problem directly.

Price increases aren't magic. They come from real value delivered by the community over time. If you want to help BCH boost its hash rate, brand awareness & more via price increases see How can I help/contribute to Bitcoin Cash?.

You can also immediately contribute to solving the issue by participating in the BCH Bank Run twice per month!

Cause of Deficit

Some obvious historical reasons BCH has struggled to keep up with regards to features like network effect & price include:

- Initial snowball: The BTC community, through the use of censorship, propaganda & backroom dealing, came out on top in the initial civil war. They received the existing Bitcoin brand, exchange ticker (and more importantly, all of the trade liquidity & technical integrations), control of the Github repository, majority of the mining hash rate, control of central (at the time) discussion platforms /r/Bitcoin & bitcointalk. The network effect of communication platforms & monetary liquidity are individually enormous hurdles to overcome - let alone both at once - and BCH thus understandably struggled at first which has compounded over time.

- Censorship & propaganda: Even since before BCH & BTC were separate coins, censorship, social attacks from the large crowd of antagonistic BTC adopters and so on have been rampant against big blockers. The BCH community have had to spend tremendous resources, time & effort educating people who have received all kinds of misinformation about Bitcoin. Misinformation is very cheap to spread and very expensive to correct, and these strategies have been very effective in controlling the Bitcoin narrative. Unfortunately, unwinding all the misconceptions about Bitcoin is much harder than giving someone the correct information in the first place, but the silver lining is that once someone learns they got told a lot of nonsense they cannot be fooled on the same topic again.

- 1 MB sellers: The initial snowball was exacerbated by all the BTC holders selling off their BCH. As a minority, heavily slandered fork, BCH suffered tremendous pain in redistributing those coins. By now, this effect has ended (anyone wanting to sell their BCH would have done so), but it hampered the community's starting resources (and thus overall progress) enormously. This price was worth paying to gain legitimate claim to the Bitcoin brand, but it was still very expensive.

- Community chaos & division / civil wars: Even after separating from the small blockers, BCH was not short of division. Internal community arguments resulted in a further two civil wars, leading to further chain splits with BSV & XEC over a period of just over 4 years. In the fast-moving cryptocurrency industry, 4 years is an eternity of time to spend mired in conflict. Network effect, already small, shrunk even further with community division. The BTC side suffered no such turmoil or coordination issues, nor did the majority of other competing cryptocurrencies, thus a BCH preoccupied with internal issues fell out of market favour and was passed by more optimistic alternatives.

- Catch-up delays: Due to being the minority coin, BCH's early days as an independent community involved a lot of time and effort in shoring up the initial deficit. Time was spent on establishing a governance process, coalescing on an altered brand, technical upgrades such as new address formats & improving the difficulty adjustment algorithm. These are not small changes, much less when requiring coordination across a decentralised (and at the time internally divided) ecosystem. Time, money and effort expended in these areas was obviously at the opportunity cost of upgrades to stay competitive in the fast moving cryptocurrency market. The silver lining of these changes is that it was a one-time cost & paying this price came with some small benefits (BCH difficulty adjustment is smoother than BTCs for example so it handles hashrate fluctuations better).

- Unrealised future benefit: The initial reason to split, increasing the blocksize, was ironically hardly beneficial - then or since. All the scaling benefit remains in the future, once BCH is regularly attracting more demand than BTC. The majority of the 1MB / block transaction traffic stayed on BTC, rendering the BCH increased scaling capacity a moot point in the short run. The BCH community is playing for keeps, shooting for global reserve currency over a period of decades, and its initial reason to break away provided no immediate benefit. In the same way that an expert chess player might sacrifice a valuable piece in the short term to gain a long term positional advantage, BCH had to suffer in the short term to maintain its long term scaling viability. Much as with the chess players the benefit of this kind of move is only apparent to a sophisticated observer thinking over the long run (which the market does not). Consider the popular saying "In the short term, the market is a popularity contest & in the long term a weighing machine". Note that the situation is reversed for BTC. Their stagnant technical choices and social consensus were beneficial at the time of the split - reinforced by the resulting short-term momentum - but are now becoming deep sticking points as their scaling plans falter & they are intractably bogged down in their past decisions.

- Market manipulation: It is absolutely without a doubt that the cryptocurrency markets are manipulated (as are other financial markets). See the information about Tether for discussion of this topic. Undoubtedly this influence on the market impacts the price of BCH, although to what extent and whether positive or negative is hard to say. BCH supporters would fathom a guess it is highly to the negative though, as BCH is a genuine threat to the existing financial power players.

- Ongoing sabotage attempts: This item is more debatable, but a conspiratorial reading of events suggests that censorship, propaganda & community disruption of Bitcoin is a targeted attack by government or banking operatives. As BTC was no longer a legitimate threat to state power once its scaling capacity was limited, their community presumably no longer had to navigate around these subvertive adversaries. BCH meanwhile likely continued (and continues) to be maliciously meddled with, which possibly explains (at least in part) the community's further splits & initial difficulties in coordinating. It's far easier to make progress without state interference, and where BTC likely had none since the split, BCH has likely had significant attention. Individuals can judge for themselves to what extent, if any, this was/is a factor - but those who believe it was can take heart that it confirms BCH remains as threating to entrenched interests as the pre-split Bitcoin.

How big is BTC's lead?

Consider also that BCH is nowhere near as far behind as a simple price chart would suggest. A BCH Flippening is not as remote as it might seem, see Can BCH flip BTC? . And note the inroads made to build a lead in important areas such as protocol development

See also: Can BCH flip BTC?

See also: Is Bitcoin Cash spreading?