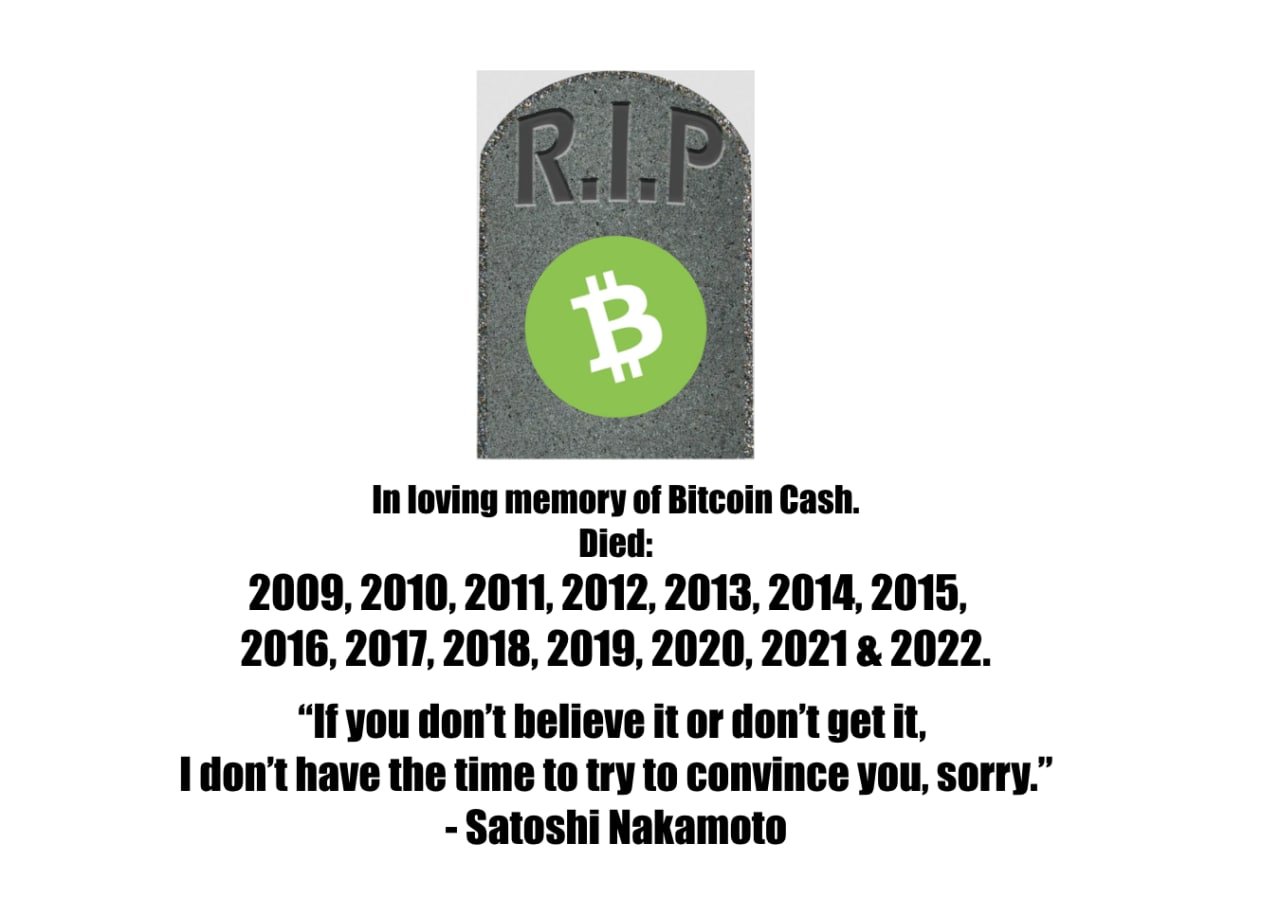

Is Bitcoin Cash dead?

No.

...and every following year, also full of constant propaganda & gaslighting that BCH is dead.

There used to be regular hand-wringing wherever Bitcoin Cash was discussed along the lines of "The project is finished, the Blocksize War is lost, and everyone should give up and sell all their BCH."

The evidence for this premise essentially boils down to one thing - fiat currency price, which tends to come in three flavours:

- USD price: "Bitcoin Cash is now at $X, it's over!"

- Coinmarketcap.com ranking: "Bitcoin Cash is now rank X, it's over!"

- BTC/BCH ratio: "Look at the ratio against Bitcoin BTC! It's now 1 to X! The market has spoken and BCH sucks! It's over!"

These complaints come from two key demographics:

- BTC adopters that feel threatened by Bitcoin Cash: Years of incessant drum-beating that "BCH is dead" is evidently self-disproving, and goes hand-in-hand with smearing the coin as "Bcash". If BCH was truly dead, there would be no need to spend all day obsessively posting on very active Bitcoin Cash discussion forums about it - much as they don't for any of the other 10 000+ smaller and non-threatening cryptocurrencies (including many that actually have died).

- Long time BCH adopters that have grown frustrated: Burnt out by the Blocksize War plus the internal drama that lead to Bitcoin SV (BSV) and eCash (XEC) subsequently forking away afterwards, some formerly-optimstic BCH supporters have become myopic to progress in the scene or grown to love the process of resentment and complaining about the past - instead of proactively contributing to the community to build a better future.

To begin with, this obsessive focus on the price (denominated in fiat currency) indicates that these complainers (of both camps) are more interested in considering BCH as a speculative investment (which it is not), instead of as a usable day-to-day currency separated from the fiat economy. Until they can make that paradigm shift, they are far better off in the BTC community, which is preoccupied almost entirely by praying for the price to go up.

If anyone is not convinced that BCH is a strong community any more, there is a very simple solution. These complainers should sell all their BCH, refocus their time on something else, and only return to the community in a couple of years time (if and) when they see conclusive evidence that the situation is different. We will still be here. This simple and bulletproof solution will make them far happier than constantly complaining about BCH.

It is undoubtedly true that the BCH community suffered a lot of pain from the original fork in August 2017 until the eCash fork in November 2020. However, there is in fact substantial evidence that since then the BCH community has grown and refocussed as a result. Now that those forks have concluded, the community has produced:

- Decentralised community organisation: Stable governance, multiple dev teams, and a growing organic community that has learnt a lot of lessons from being censored, marginalised and had its devs co-opted - those attacks won't work again.

- Improved scaling efforts: The BCH community now has ABLA plus ongoing efforts into technical scaling & infrastructure. BCH has a responsible but effective scaling plan, and will not be bottle-necked by technical issues as community growth continues and momentum snowballs.

- Peer-to-peer cash adoption: Real-world (not online) merchant adoption and commerce is starting for BCH at a scale no other coin is even close to. Two excellent examples are St Kitts & Nevis and the "Bitcoin Cash City" in Townsville, Australia.

- UTXO DeFi: Bitcoin Cash is developing a whole different direction of UTXO-based DeFi beginning with on-chain protocols such as AnyHedge and consensus protocol improvements such as CashTokens. The BCH community has continued powering forward on protocol upgrades & has a developing DeFi ecosystem that is already industry leading (albeit small, as of 2024). This makes Bitcoin Cash the only coin that is simultaneously a better functioning version of both Bitcoin & Ethereum, the two market leading cryptocurrencies.

- No further fork drama: Since eCash left the scene, internal community division has largely vanished and there have been no proposals for (or even beginnings of) another fork.

If any more evidence is required, there is hundreds of hours of The Bitcoin Cash Podcast documenting a non-stop explosion of innovation in the scene, and you can see the resulting network activity and interest reflected in the statistics.

This is even before considering the raft of issues that other coins have which BCH does not suffer:

- Enormous transfer fees

- Intermittent chain downtime

- Centralised VC coin stashes

- Centralised developer teams

- Legal troubles with various government financial regulators

- Lack of proven resilience under community strain / price declines

- ...among others.

Considering all the cryptocurrencies available on the market, BCH is already well clear of a lot of problems that are or will prove huge liabilities over time for its competitors.

The price of BCH will turn around as the market weeds out less resilient/useful alternatives. However, that will not be a quick process, and BCH should not be considered as a speculative investment but instead used as a daily currency.

The true "winner of cryptocurrency" will only be clear once every single person on the planet makes every single purchase using on-chain cryptocurrency, and fiat currency has been totally eliminated from the entire world. By that metric, the war is just barely beginning. People needing to ask "Isn't it over?" is in itself sufficient evidence that clearly it is not. This explains why cryptocurrencies are so tribal.

See also: What's with the name "Bcash"?