What about Monero (XMR)?

Every coin has its pros and cons, and so an unbiased objective take is impossible. Cryptocurrency is a free market of ideas and voluntary involvement, and the best coins must prove themselves in it, including BCH. Readers are encouraged to explore the communities, apps and events that other coins have to offer and hear both sides of the argument. However, as a candidate for being the global reserve currency, other coins tend to have serious flaws that make them a less viable candidate than BCH. BCH is not perfect, it has its pros & (cons)[/faqs/BCH/why-not-bitcoin-cash], but it (subjectively) has the best chance of becoming global reserve currency.

The Bitcoin Cash Podcast is **not an expert in every alternative cryptocurrency, nor able to argue for their merits**. If you think this article is inaccurate or needs adjusting, please help to improve it and submit a PR with your suggested improvements instead of complaining that it doesn't reflect your own opinions or knowledge.

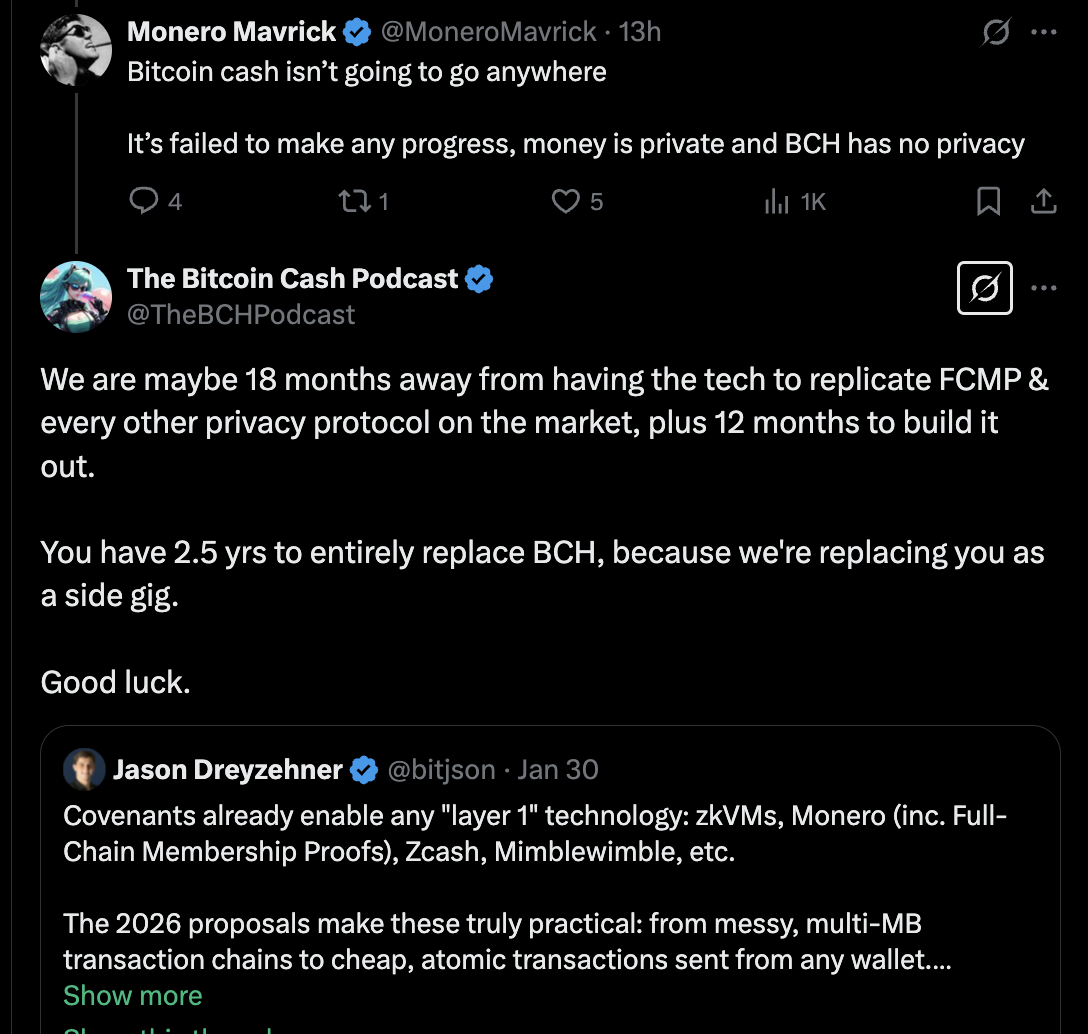

By mid-late 2027, BCH is likely to have equivalent or better privacy tooling to XMR (& any other privacy coins), rendering it obsolete. Without that, their coin has little else to hang its hat on. Source & see the related thread here.

The Monero community is perhaps the closest ideological cousin of the Bitcoin Cash community, and there is significant cross pollination of users and ideas. Both coins focus on optimising as much as possible to the fundamental principles of money and being a peer-to-peer electronic cash. Monero users are heavily focussed on privacy protection, as that is built into the core protocol, and frequently highlight the improved fungibility of XMR vs BCH or other coins. This also leads to it being regularly used on darknet markets, which may be a leading indicator for adoption similar to the ways that Bitcoin in its early days was used the same way.

However, these advantages come with significant trade-offs, that make global adoption of Monero very very unlikely.

XMR Criticisms & Counter-Arguments

Inaudibtable & increasing supply

- Criticism: Monero advocates will claim that the supply can be mathematically audited, but what they miss is that the difficulty inherent in people understanding the complicated maths around that concept makes it less likely to be adopted when compared to the inherent simplicity of Bitcoin's 21 million publically known coins. The mathematical possibility of an audit is not as important as the simplicity of convincing new adopters that the system is fair and works as promised. There is also an increased chance of unnoticed software bugs creeping into XMR nodes (which increases in proportion to increasing node software diversity - a negative incentive), and while the likelihood or degree to which this is a problem is subject to debate, there is no debate that it is a higher chance than for a very easily verifiable supply currency such as Bitcoin Cash. Given that scarcity of supply is a critical component of cryptocurrency's monetary properties, this decrease in verifiability is a big issue. Furthermore, ongoing inflation (aka "tail emission") is not a solution to network-security, simply a band-aid that tries to obfuscate the need for sufficient transaction volume.

- XMR Counter-argument: Supply is automatically audited by running a node, just like on BCH or most other cryptocurrencies. Cryptography used in XMR is decades old & unlikely to have critical undiscovered flaws. Inflation is less taboo in the XMR community anyway, ongoing inflation is important to guarantee network mining security.

Regulatory pressure

- Criticism: Although government can't stop cryptocurrency, they can choose where to distribute their efforts to slow it down. So far, they have placed inordinate amount of resources against Monero (and some similar coins), leading to it being delisted from many consumer-friendly cryptocurrency exchanges. This greatly decreases the ability for the coin to spread among end consumers, particularly in the initial race to hit critical-mass and especially relative to other coins competing in the "cash" use case. It is admirable the XMR community is committed to fighting through this handicap, but nevertheless they are paying a very high price for their principles (although this is not a strategy unknown to BCH, as seen with BCH branding).

- XMR Counter-argument: If your coin relies to any significant degree on availability through centralised exchanges, that indicates a lack of decentralised economy & exposes a weakness which will be exploited at some point. Tolerating KYC at exchanges in the name of increased end consumer access is a bad trade-off. Preserving a private economy is critical even if it means slower or no mass adoption.

Global scalability

- Criticism: Due to the obfuscated nature of transactions, blockchain pruning is not an option for Monero. This severely limits its ability to be used at global scale with large numbers of running nodes to ensure decentralisation. More discussion of this issue here.

- XMR Counter-argument: Global adoption is not the XMR end goal as it is for BCH. In the XMR community, "Monero is for anyone, not everyone". XMR needs to be available to all, but global adoption is not a necessity, it's most important for XMR to serve the users who specifically need & want it.

Lack of DeFi

- Criticism: The XMR community may see this as an advantage ("lack of distractions on p2p cash mission"), but from a BCH perspective the XMR community may struggle to compete with the demand (liquidity, network effects, developer interest) generated by competitors with those features. In the case of BCH that means CashTokens & SmartBCH.

- XMR Counter-argument: Everything requires trade-offs & the XMR community values optimising for privacy & the cash use-case over DeFi use cases.

The BCH community is heavily committed to privacy and fungibility as a core tenet of sound money. However, it has a different approach to the Monero community.

To find out more about Monero, some resources to look at include:

See also: What about privacy on BCH?

See also: Why Bitcoin Cash instead of another cryptocurrency?