What about Nano (XNO)?

Discussion & debate with Milan, a prominent XNO advocate, about the pros & cons of different coins.

Every coin has its pros and cons, and so an unbiased objective take is impossible. Cryptocurrency is a free market of ideas and voluntary involvement, and the best coins must prove themselves in it, including BCH. Readers are encouraged to explore the communities, apps and events that other coins have to offer and hear both sides of the argument. However, as a candidate for being the global reserve currency, other coins tend to have serious flaws that make them a less viable candidate than BCH. BCH is not perfect, it has its pros & (cons)[/faqs/BCH/why-not-bitcoin-cash], but it (subjectively) has the best chance of becoming global reserve currency.

The Bitcoin Cash Podcast is not an expert in every alternative cryptocurrency, nor able to argue for their merits. If you think this article is inaccurate or needs adjusting, please help to improve it and submit a PR with your suggested improvements instead of complaining that it doesn't reflect your own opinions or knowledge.

The Nano community, similar to Bitcoin Cash, is laser focussed on real commercial adoption as electronic cash. It has some popular talking points, but none of them are significant enough to help them gain critical-mass traction. The main points that advocates often make and their rebuttals include:

- Zero fees: XNO offers $0 transfer fees to consumers. In practice, to an individual end-user this is no different to the $0.001 fees of Bitcoin Cash - end users do not switch currencies over fees so trivial they never even notice them. However, there is no such thing as a free lunch, Bitcoin Cash's individually tiny fees in aggregate allow it to fund ecosystem security (particularly at scale) but Nano instead has to spread that cost into other parts of its ecosystem (e.g. to node operators).

- Instant transactions: Just as with fees, there is no end-user perceivable difference between Nano and many other "instant" cryptocurrencies, including Bitcoin Cash. Bitcoin Cash has secure 0-confirmation transactions to $10 000+ which are just as fast as Nano, and any larger transactions are not only rare but generally not conducted with haste so great that it can't afford waiting 10 minutes for a block confirmation (when buying a house, it takes some time to sign the papers).

- No centralised mining: Mining is not centralised, over more than 13 years of history Satoshi's economic incentives have proven strong enough to redistribute hash rate to keep miners decentralised. The accusation of "centralised mining" relies on a flimsy unsophisticated projection that "economies of scale" will (some day) centralise mining, although there is no evidence of that happening even with the current gigantic mining industry.

- No environmentally unfriendly mining: Mining is not an environmental problem, simply a convenient criticism to uninformed skeptics. Even if this was a real issue, Nano would be easily defeated by the much larger networks using Proof-of-Stake algorithms that are similarly low in energy consumption.

Nano's design trade-offs also come with some big drawbacks, which are generally underappreciated by supporters:

- Unfair distribution: A lack of mining and inflation meant there was no way to do a generally fair initial distribution. Instead, coins were distributed by some kind of CAPTCHA scheme, which is difficult in hindsight to demonstrate as provably fair. Whether or not it was fair, it's very difficult to convince new adopters that it was - which is already widely accepted as the case for Bitcoin Cash.

- Lack of investment Schelling point: The Bitcoin mining industry is not only important for security, but for investor confidence. Billions of dollars has been invested by a wide variety of international actors in this infrastructure, which is a sunk-cost that there is a very high incentive to defend (by ensuring the health of Bitcoin Cash and other Bitcoin forks). Nano has no such thing, making the industry far less convincing to external investors as a viable project.

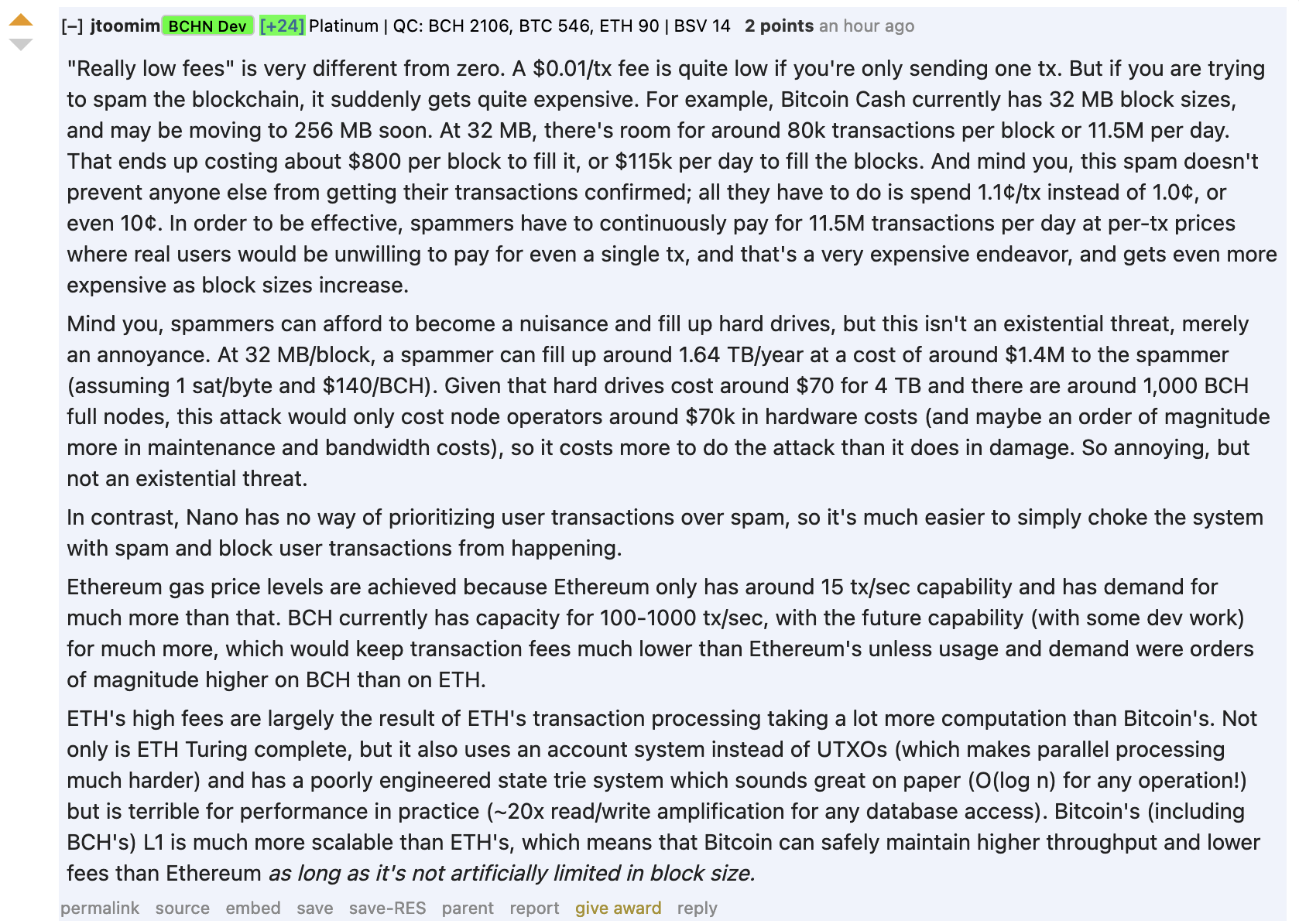

- Spam attacks: Lack of a trivial payments transfer fee (which makes huge volume spam attacks on Bitcoin Cash costly and unsustainable) lowers the barrier to flooding the Nano network in a denial of service attack. The community has had issues with this in the past, and while they do implement or upgrade with various solutions, fundamentally if the cost to transfer on the network is essentially non-existent there will always be a way to spam.

This is before considering:

- Far lower network effect of Nano

- The less recognised brand

- The lack of DeFi (such as AnyHedge or CashTokens). The XNO community may see this as an advantage ("lack of distractions on p2p cash mission"), but from a BCH perspective the XNO community may struggle to compete with the demand (liquidity, network effects, developer interest) generated by competitors with those features.

- The lower appeal to cryptocurrency users that have already accepted the fairness and strength of the Bitcoin launch/design

- ... plus all the other reasons why Bitcoin Cash instead of another cryptocurrency.

Nano advocates that truly believe in the peer-to-peer cash vision would be far better off joining Bitcoin Cash and continue boosting its much larger network effect.

Here is an excellent breakdown of the spam issue from Johnathon Toomim.

For more discussion, see this Twitter thread where I discussed BCH vs XNO in detail with Mira Hurley, a prominent Nano advocate.

See also: Why Bitcoin Cash instead of another cryptocurrency?